From Credit Card Fears to First Class Flights

I hear it all the time:

“Oh, I’d LOVE to travel in first class, but I don’t want my credit score to go down.”

I get it! I used to think the same thing. Growing up, my dad was a commercial banker, and I was taught that credit cards were bad. I avoided them for over 20 years. But everything changed when I took the time to actually learn how credit scores work.

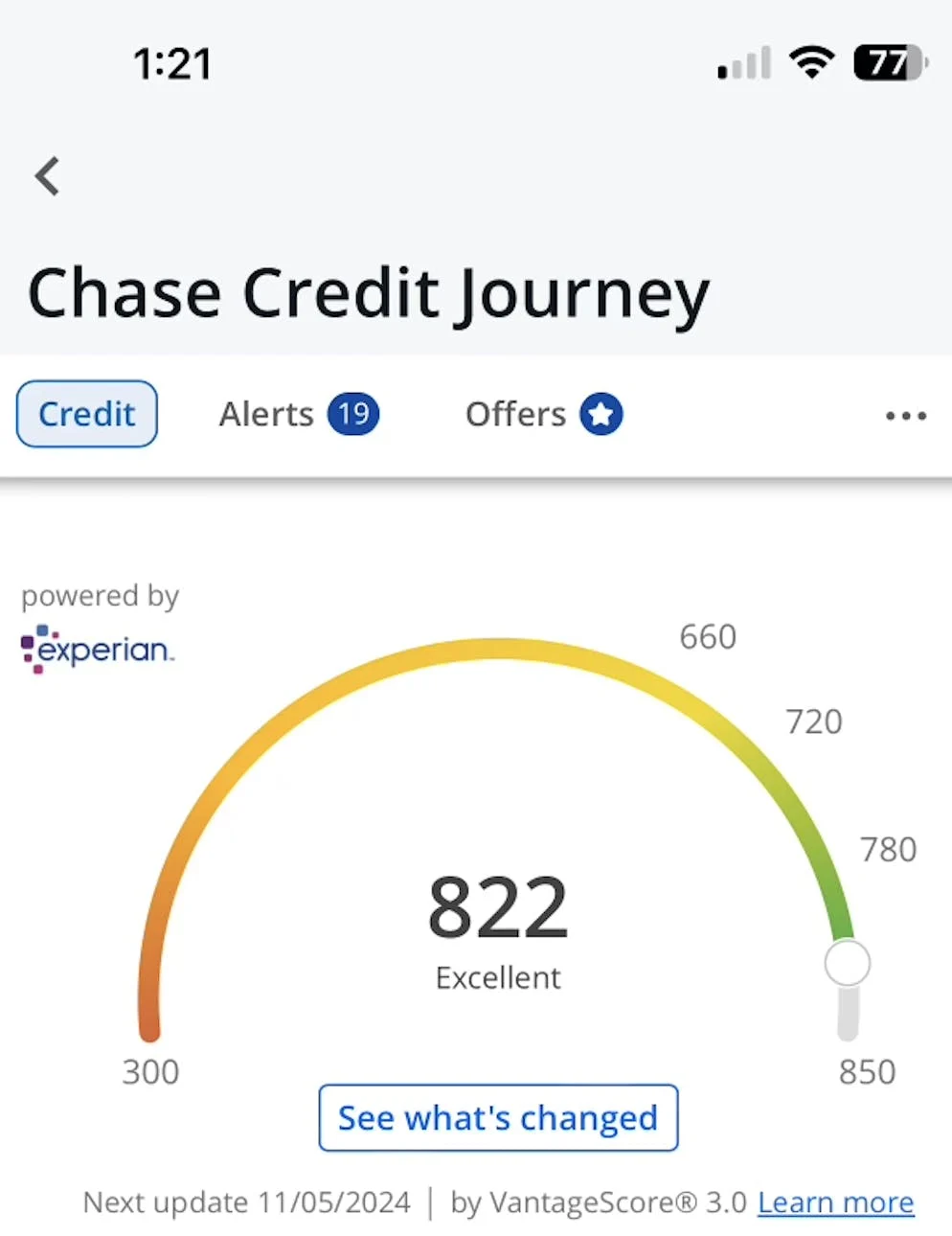

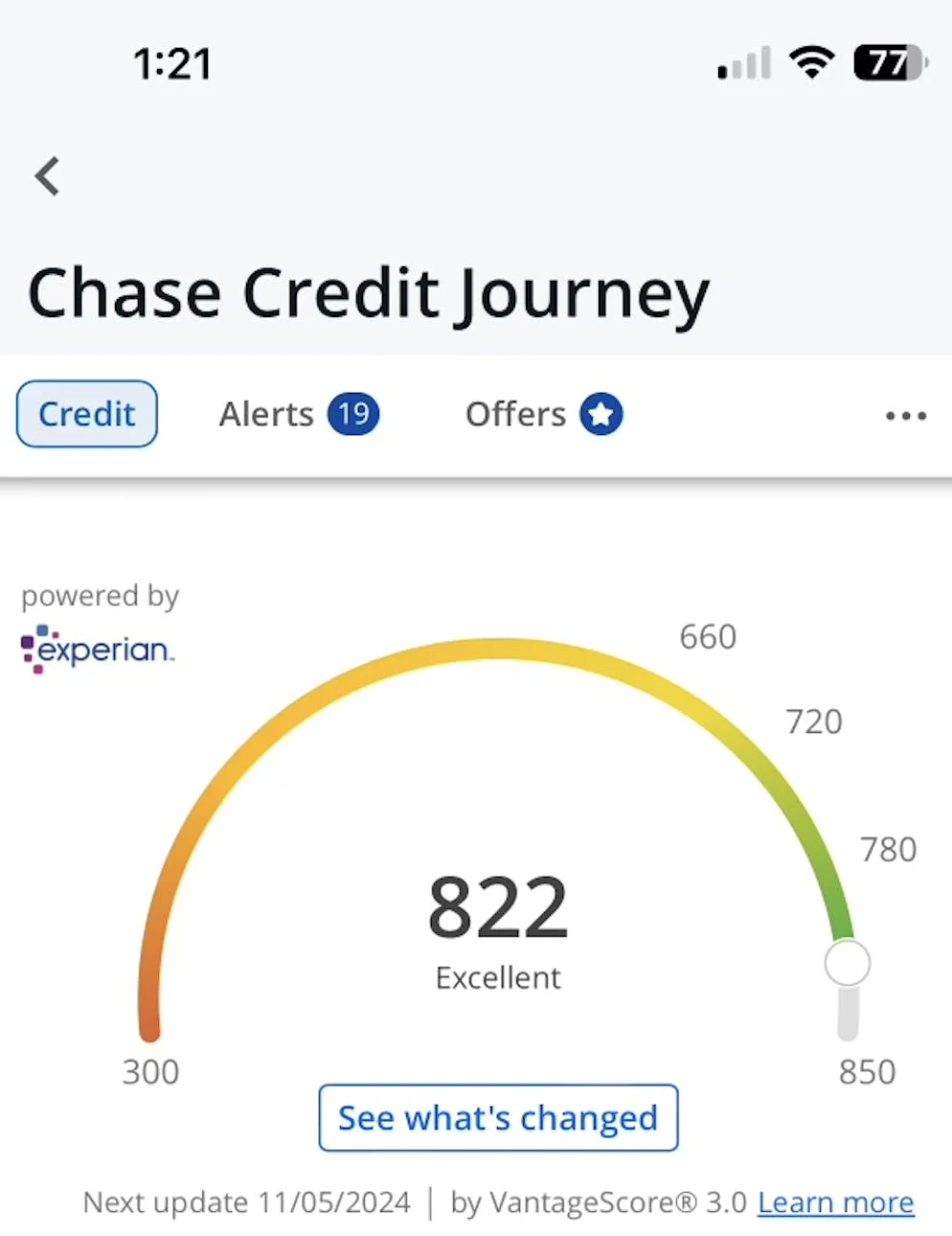

Once I understood how to use credit cards the right way, I started booking amazing trips to places like Bali, Paris, and New Orleans—all by responsibly leveraging credit card points. And guess what? My credit score has NEVER been higher!

Here’s the thing you need to know (it’s actually the opposite of what most people think):

How Your Credit Score is Calculated

The biggest chunk (35%) of your credit score comes from your payment history. The key here is to use your credit card like a debit card—meaning, pay off your balance in full each month.

Next up, the second biggest factor (30%) is how much you owe compared to the total credit available to you. This is where the magic happens.

Opening new credit cards actually boosts your score. Why? Because when you open new cards, you get more available credit. And if you’re paying off your balances, your credit utilization goes down. This low utilization helps increase your score!

Now, before you think this sounds too good to be true…

I’ve seen it firsthand. My students, like Brian and Christa, have seen their credit scores soar. Scott’s score jumped by 50+ points in just 8 months of working with me!

Check out my latest score from my Chase app—822 out of 850—and I’ve opened several cards over time!

So now the question becomes...if credit cards can be a TOOL to help you reach your travel dreams, what's possible for you now?